Menu

Menu

Menu

Menu

July 1, 2021

Government spending and money printing are bringing the economy roaring back from the COVID recession. Current conditions are continuing to improve strongly. Although many statistics use year-to-year comparisons, which can exaggerate growth readings by comparing to the low levels of last June, the trend is still clearly improving. The massive government financial intervention that was needed to produce these results, however, is not likely to be a free lunch. As with prior deficit spending for bailouts and handouts that increases debt, the bill will come due sometime in the future. In contrast, spending for infrastructure that improves productivity, and actually provides a real investment return, rather than stimulus program “helicopter money”, can have a long-term economic benefit

Vaccinations that were developed last year and came on stream recently, have stabilized the economy and provided a launching pad for renewed growth, accelerated by pent-up demand. Growth measurements are up across the board. GDP is up 6.4%. Employment is up, while unemployment is back down to 5.8%. Home prices are up 17.5% nationally, and home sales prices greater than asking price are anecdotally common, as bidding wars erupt. Continuing government support has lifted the stock market to new highs, but the easy money policies have also spawned speculative excess like the Bitcoin cryptocurrency, blockchain digital artwork in non-fungible tokens (NFTs), special purpose acquisition companies (SPACs) , and the meme stock (GameStop, AMC) craze fueled by social media. These are interesting and unusual times. They are likely to be remembered similarly to the dot.com bubble of 2000 or the Roaring 20’s. Future generations will ask, “What were they thinking?”>

Parts of the stock market have begun to resemble a casino. It has shown the potential for quick rewards, and losses that are just as quick. Stock values have lost all connection to underlying fundamentals. New financial structures with limited or no intrinsic value are attracting $billions. Bonds are similarly overvalued, although they recovered somewhat during the quarter. The challenge of the stock market is balancing the fear of missing out on a potential hyperbolic advance versus the risk of a rapid crash or worse. Investing has become potentially lucrative short-term, but also a dangerous game. The days of rationally considering the value of future returns are gone for now. The Fed had made it clear however that they planned to support the markets by not raising interest rates until 2024. Recently, however, that time changed to 2023, so any perceived guarantees now appear to be suspect. Unless the Fed is adroit, changes in their supportive policy may be received by the markets with a rapid and serious “tantrum” or worse.

There is a psychological concept called “recency bias”, which, according to Wikipedia, is a cognitive bias that gives "greater importance to the most recent event". If it is summer and the weather is hot, recency bias leads one, quite rightly, to pay more attention to their air conditioner than their furnace. This bias is especially strong if the observer has no direct experience or acquired knowledge that would challenge the assumption. Without other contradicting information, it could be imagined that summer will go on forever and a furnace is useless.

Recency creates momentum in the investment markets as investors observe trends and expect them to continue. There may not be any reason for making an investment other than the expectation that a position will be able to be sold at a higher price later to someone else (also known as the “greater fool theory”). This can continue indefinitely until there are no more greater fools, at which time the momentum shifts, prices fall, and recency suggests the fall will last forever.

We are currently witnessing this effect in spades with the meme stock craze, bidding up GameStop from $20 to $480 over eleven days before dropping back to $40 (currently $219). Bitcoin running from $10,000 to $63,000 and back to $32,000 in nine months is another example. The common denominator between these examples and the stock and bond markets in general is that little or no attention is being paid to the underlying value of the investment. The Federal Reserve is maintaining an environment where the payback from low risk investments is less than inflation. Accepting more risk appears to be the only alternative. With Fed money printing and government handouts to everyone, there is plenty of money available with no place to go. Who cares about value? All are intent on finding the greater fool.

Recency bias is also present in the demographics of investors. The Financial Regulatory Authority (FINRA) reports that, of the brokerage accounts that existed at the end of 2020, 57% were newly opened in that year. Of those new accounts, 65% were opened by new investors. Of the new investors, 62% were less than 44 years of age. We can guess that many of these “new” investors may have some prior investment exposure through workplace 401ks and the like. Nevertheless, the accelerating explosion of market interest can be ascribed to government policy, recency bias, and the “meme” phenomenon, not because compelling intrinsic value has been discovered.

Value is hard to define, but it is none-the-less an important dictator of future returns. If an investment has some (currently unknown) price in the future, the difference between today’s price and that future one defines the return. If today’s price is excessively high, returns over the holding period will be low and vice versa.

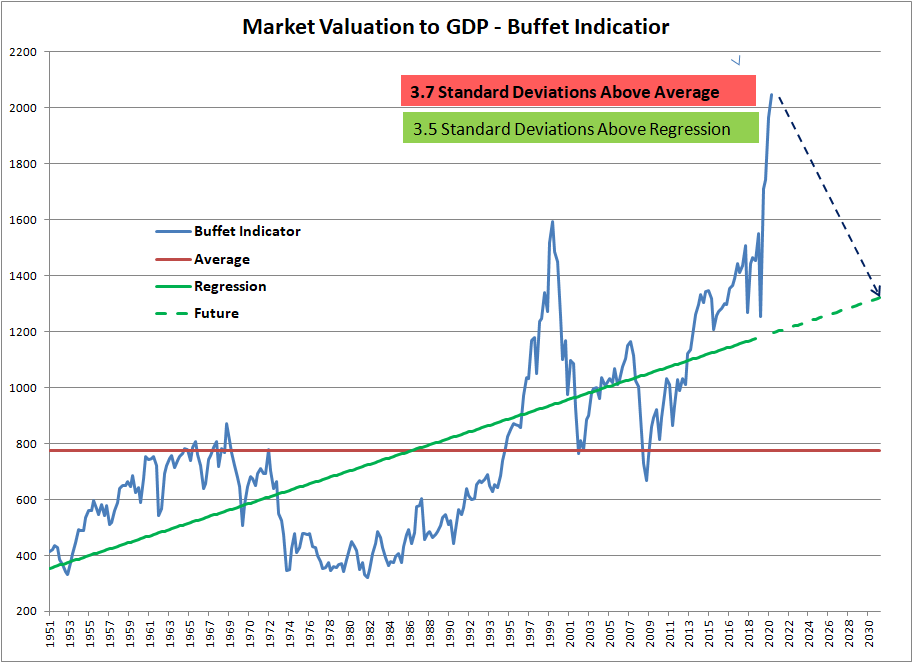

The graph on the left shows the ratio of Market Capitalization/GDP, which Warren Buffet called his favorite indicator back in 2001. Whether you look at the average or the regression line, the result is virtually the same. Market value is currently about 3.5 standard deviations above normal. This graph may overstate the results somewhat, due to the COVID slowdown, but other long-term valuation indicators, like Robert Shiller’s CAPE ratio show a similar story. Regardless of the statistics, it is visually clear that this is an unusual situation and valuations are at nosebleed levels. The dotted black lines suggest what could happen over the next 10 years just to get back to normal. Large cap long-term return models from GMO’s Jeremy Grantham and John Hussman suggest annual returns may be -7.3% over 7 years and -6.2% over the next 12 years respectively. The current gains are simply borrowing from the future.

Market manias can continue for a seemingly long time, even though they are just an historical blip in the longer term. However, mere mortals may not have the long term to recover from the aftermath. Planning based on historical averages is valid only from a base of normal valuation. Planning with reduced expectations is more appropriate today. If you create and maintain a financial plan adjusted for the current environment, you will be ready. LFM&P is ready to help when you are.

David C. Linnard, MBA, CFP®

President

LINNARD FINANCIAL MANAGEMENT & PLANNING, INC.

46 CHESTER ROAD

BOXBOROUGH, MA 01719

Barbara V. Linnard

Vice President

LFMP@LINNARDFINANCIAL.COM

WWW. LINNARDFINANCIAL.COM

978-266-2958

|

|

|

A Registered Investment Advisor and NAPFA-Registered Financial Advisor

The contents of Outlook & Trends reflects the general opinions of LFM&P, which may change at any time, and is not intended to provide investment or planning advice. Such advice is only provided by means of individual agreement with LFM&P.