Menu

Menu

Menu

Menu

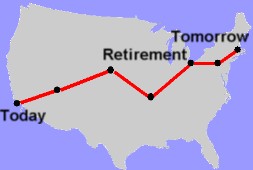

Providing for retirement has changed over the last three decades. Company funded pensions plans are becoming scarcer. Tax-deferred retirement plans have gained the forefront. The difference today is significant. In the old pension plans, the company promised you a guaranteed income for life. The pension plan was professionally managed. The 401(k) and 403(b) replacements have removed both the guaranteed income and the professional management. The financial risk that the company used to bear has been placed squarely on the shoulders of the retiree. Continuing inflation compounds the problem. It will continue to erode your purchasing power long after you can no longer count on pay raises to keep up.

In this new environment, it has become your responsibility to provide for your own retirement. Social Security can help, but for most people it is not enough, and it may have future solvency problems of its own. You will need to start saving in the tax-deferred plans as early and as much as possible. You may need to contribute additional savings to taxable accounts as well.

LFM&P can help you determine how much you need to save and how to allocate your funds. We begin with your desired lifestyle and estate goals. We project how much money you will need to live. Because investment gains are typically a necessary and important contributor to retirement savings, we look at your risk tolerance, suggest an appropriate asset allocation, and calculate how much you will need to save. Investments have risk though. Using “average” investment results used to calculate many retirement projections are only of partial value to you, and may actually be harmful. You do not want to plan to have a 50% chance of running out of money in retirement. We will help you reduce this chance by using historical data to simulate most possible investment results and determine the probability of being successful.

LFM&P can be very helpful to people who are considering retirement within the next several years or are newly retired. The thought of imminent retirement can be mind-boggling. Instead of relying on a steady employment income, all of a sudden you may be faced with coordinating a combination of retirement accounts, social security and other lifetime savings. Common questions are:

LFM&P can answer these questions and more, after reviewing your financial position in its totality and how it relates to your goals. Because of abnormally high current market valuations, your accumulated assets could decline in a poor investment climate. For this reason, estimates that use historical investment returns could provide an overly optimistic picture these days. LFM&P uses our own simulator to take into account the affect of market valuation on likely future returns. The overall analysis can either confirm that your goals can likely be met, or we can recommend actions you can take to improve your preparation. We provide you with a written report that you can refer back to, including a timeline of actions to take and financial events that you are planning. We provide you with a projection of what your income and expense will be, and how your wealth will grow (or diminish) as time goes on.

It is worth mentioning that, although we consider retirement planning and investment management to be separate activities, investment is usually an important part of the execution of most people's retirement plan. LFM&P's risk-managed investment approach is most applicable for risk-sensitive people like those in retirement.

8-31/